2016 Readers' Choice Survey: Demand Data Analytics

By: Lora Cecere, Founder, Supply Chain Insights

Customers are fickle. Markets are ever changing. Companies want to be responsive to demand, but how do they get a good demand signal? This is more difficult to achieve than it seems, and it starts with demand analytics.

The demand analytics market is fragmented with many small vendors. The market is very competitive and confusion abounds. For the user, frustration abounds for three reasons:

1. Functional Solutions. Most of the solutions purchased are targeted to help a functional unit. The demands of marketing for demand data are very different than those of sales or the supply chain. Only the most mature companies understand the need for harmonized and synchronized data that can be used cross-functionally.

2. Analytics and Demand Data from the Same Source. The solution providers only deliver data or analytics. No vendor has cracked the code to deliver a solution that effectively combines data and analytics.

3. Timely Insights. Companies are drowning in data, but find it difficult to deliver insights. Increasingly, companies are looking for prescriptive and cognitive solutions to identify and highlight unknown market opportunities.

4. Data Granularity. Retailers aggregated early deployments of demand data, and store-specific level data was sparse and largely inaccurate. This is changing.

5. Sensing. A driver for the adoption of demand solutions is the sensing of out-of-stocks and the triggering of replenishment. While this is the promise, the market solutions are still being refined.

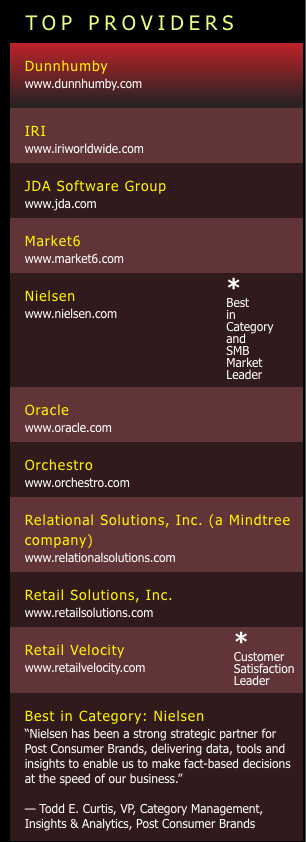

The list is a composite of differing solutions. The demand analytics solutions that are the most used by marketing are IRI and Nielsen while Market6, Orchestro, Retail Solutions, Relational Solutions and Retail Velocity are used by sales. JDA, Oracle and SAP are more focused on delivering answers for supply chain leaders.

Cloud deployments are gaining acceptance with over 3/4 of the user base preferring a cloud-based deployment. The use of the cloud improves data acquisition and time to value for the solution. Retail Solutions was an early mover in cloud-based solutions, and used this positioning to gain market advantage.

Nielsen is gaining market share over IRI and ranks higher in user satisfaction with marketing teams than IRI. Retail Velocity ranks the highest with sales leadership teams in the area of sales reporting.

Most of the vendors on the list have tried to combine data and analytics solutions together to drive more value, but none have succeeded. For the user, it is a market waiting to happen. There are lots of promises with immature solutions in a fragmented and competitive market. In summary, the demand analytics market has many solutions, but needs to evolve and mature to solve the greater business problem.